Fair Compensation at Risk: How Undervaluation in Insurance Settlements Hurts Policyholders

Each year, millions of vehicles across the United States are classified as total losses following accidents and the frequency of such claims continues to rise.

Many policyholders are frustrated by insufficient settlement offers that don’t match the market value of their vehicle, even with this increase. Thankfully, there are options available to consumers. By using independent appraisals, speaking with legal experts, and painstakingly gathering proof that demonstrates the actual value of their car, they have the legal right to contest inadequate payouts.

A new investigative report by Bader Scott Injury Lawyers delves into the real financial burden these undervalued settlements place on everyday Americans. This analysis offers critical insights for anyone who may face a total loss vehicle claim in the future.

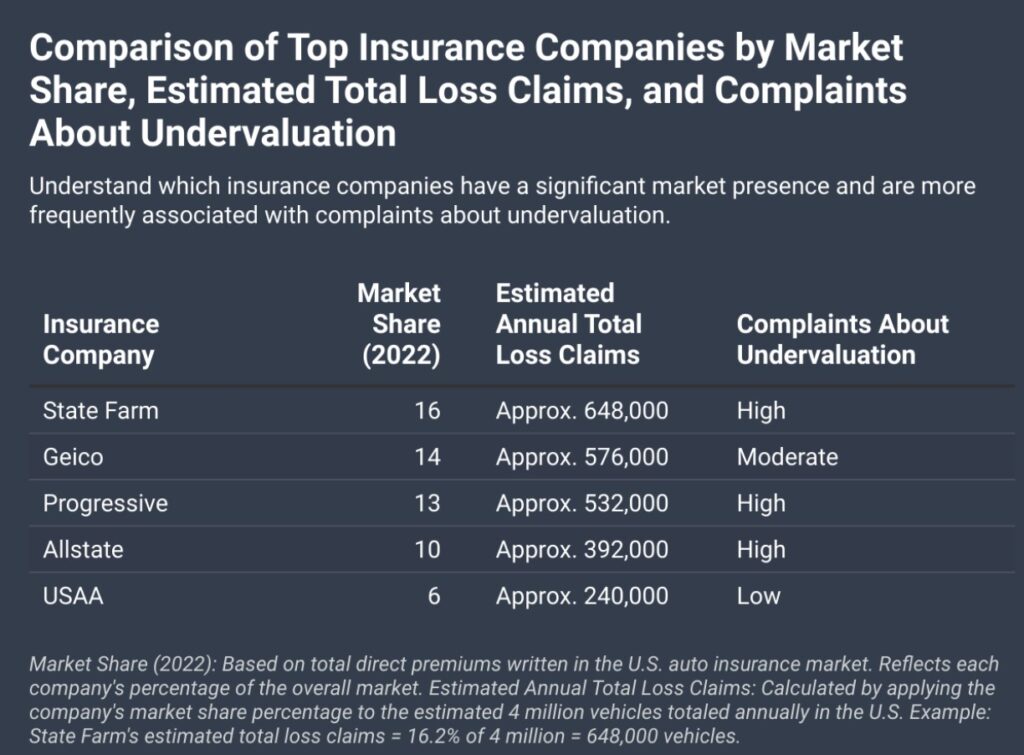

(Table: Bader Scott Injury Lawyers; Source: Insurance Information Institute; Visualization by Datawrapper)

According to the LexisNexis U.S. Auto Insurance Trends Report, cited in the Bader Scott study, the automotive insurance landscape has seen a dramatic rise in total loss claims in recent years. Specifically, over 25% of all collision-related claims in 2023 were declared total losses. That’s a significant portion of policyholders walking away with reduced compensation for their damaged vehicles. The volume of total loss declarations increased by 29% between 2020 and 2023, indicating a concerning trend for both regulatory bodies and insured individuals.

Table of Contents

ToggleWhy Do Total Loss Payouts Frequently Fall Short of Expectations?

Several systemic problems that lead to the undervaluation of totalled vehicles are identified by the Bader-Scott study:

- Outdated Valuation Tools – Some insurance providers use pricing models that fail to take into consideration the current market value of automobiles.

- Not having gratitude for personalised features like upgraded interiors, performance adjustments, custom wheels, and tech integrations are examples of improvements that are typically overlooked.

- Being dependent on inaccurate sources for data might result in assessments which may not be accurate and market trends or demand.

These actions have annoyed customers and attracted legal notice. For instance, a class-action lawsuit has been filed against State Farm for allegedly routinely undervaluing claims for total losses. In a significant legal development, U.S. District Judge Virginia Kendall recently allowed the lawsuit to move forward. This implies that judicial oversight may expedite reform implementation.

The Effect on Policyholders’ Finances

A person’s financial situation may be significantly impacted if they are paid less than the value of their car. Many people are compelled to pay cash for a replacement car, take out auto loans on a car that doesn’t exist, or forego vehicle safety and quality when replacing their car because their insurance doesn’t cover enough of the cost. In general, the difference between the actual value of the car and the offer made by an insurer.

These shortcomings have real-world consequences in addition to statistical ones, like decreased productivity at work, problems with transportation, and even psychological distress as a result of a delayed accident recovery.

Actions Car Owners Can Take to Safeguard Their Rights

Customers must be proactive during the claims process because of the stakes. The following are important actions that all policyholders should think about:

- Keep a record of everything: Keep a thorough record of all vehicle modifications, aftermarket components, and maintenance records. This aids in proving increased value when making claims.

- Know Your Car’s Value: Get in touch with reliable sources such as Edmunds, the NADA Guides, or the Kelley Blue Book to get to know the real and the fair market value of your car before accepting any insurance settlement.

- Don’t Accept the First Offer: Always consult with your insurer and discuss the matter if the payout doesn’t seem fair and positive.

- Request an Independent Evaluation: A third-party expert’s objective evaluation can yield an accurate totaled vehicle value.

- Request a Complete Damage Report: To confirm that a total loss designation was appropriate, it is crucial to comprehend the extent of vehicle damage.

A Drive for Reform and Accountability

Advocates for consumer protection and legal experts are calling for more regulation of insurance practices as these problems become more widely known. The goal of proposed regulatory reforms is to guarantee that insurers determine a vehicle’s value using accurate, current, and transparent methods. The goal of these initiatives is to ensure that policyholders receive what they are entitled to by bridging the gap between insurance settlements and actual market prices.

Bader Scott Injury Lawyers Issued a Firm Statement on the Matter

“Many people are probably receiving significantly less than their vehicles are worth after a total loss,” said a firm statement from Bader Scott Injury Lawyers. Our goal is to draw attention to these unfair practices and fight for customers who are entitled to better treatment from their insurance companies. The emergence of these legal actions is a significant step toward industry accountability and reform.

What to Do If You Believe a Settlement Is Injusticed

If you think that the insurance company has undervalued your totaled vehicle, take immediate action. Contact an experienced attorney who can help you get the settlement offer you rightfully deserve. A proper legal aid can be very beneficial in negotiating a better outcome or, if necessary, pursuing litigation.

Residents of Atlanta and the surrounding areas are encouraged to contact a reputable Atlanta auto accident lawyer for a free consultation. These professionals can assist you in battling for the full amount of money you are entitled to and thwarting lowball settlement offers.

For today’s car owners, the rise in total loss claims and the frequency of unfair settlement practices pose a significant problem. Insurers are essential in helping people get money back after an accident, but they also have an obligation to act honestly and openly. Industry reform is made possible by consumer advocacy and legal scrutiny, such as that provided by Bader Scott Injury Lawyers. Policyholders must continue to be watchful, knowledgeable, and prepared to defend their rights until that time.

Published by Carol Jones

My aim is to offer unique, useful, high-quality articles that our readers will love. Whether it is the latest trends, fashion, lifestyle, beauty , technology I offer it all View more posts

Recent Post

How to Transform Your Smile This Summer